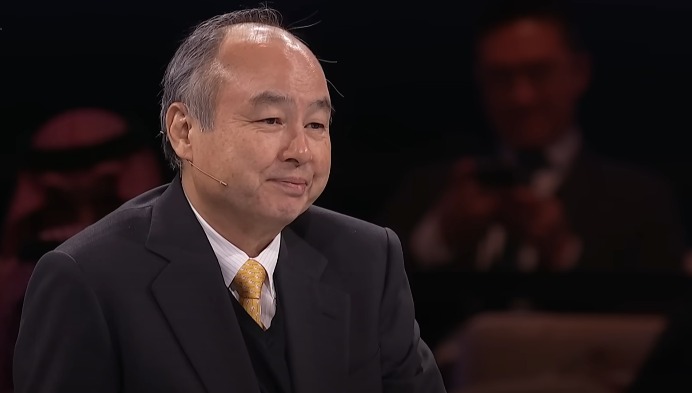

Masayoshi Son: Decoding the Untold Story of His $28 Billion Fortune

Introduction: The Tech Visionary Behind SoftBank's Empire

With a staggering net worth hovering around $28 billion, Masayoshi Son, the visionary founder and CEO of SoftBank Group, has undeniably cemented his position as one of the most influential figures in the global technology and finance landscape. But how did he amass such an impressive fortune? Was it just luck? Absolutely not! It's the culmination of decades of calculated risks, strategic investments, and an uncanny ability to spot emerging technological trends long before they hit the mainstream. His investments and business decisions have reshaped industries, solidifying his legacy as a leader in technology-driven transformation.

The Early Years: From Humble Beginnings to Entrepreneurial Spirit

Masayoshi Son's journey didn't start in a gilded tower. Born in Japan to a Korean immigrant family, he faced challenges early on. Did these challenges deter him? Quite the opposite! They fueled his ambition and resourcefulness. While studying at the University of California, Berkeley, he wasn't just hitting the books; he was already building his entrepreneurial muscle. He reportedly developed an electronic translator and sold it to Sharp, generating his first million dollars. Talk about a head start!

The Aha Moment: Recognizing the Power of Technology

His time at Berkeley wasn't just about making money. It was about understanding the potential of technology. He saw the future, a future where computers and the internet would revolutionize everything. This early realization became the foundation upon which he built his empire.

The Birth of SoftBank: A Risky Gamble that Paid Off

Returning to Japan, Son founded SoftBank in 1981. Initially, it was a software distribution company. Seems simple enough, right? But Son had bigger plans. He envisioned SoftBank as a holding company, a vehicle for investing in and nurturing promising tech startups. This was a bold move, a gamble that many considered foolish at the time. But Son wasn't deterred. He saw something others didn't.

Early Investments: Laying the Foundation for Growth

One of SoftBank's earliest and most crucial investments was in Yahoo!. Son recognized the potential of the internet search engine early on, pouring significant capital into the company. This proved to be a game-changer, generating massive returns and solidifying SoftBank's reputation as a shrewd investor.

Riding the Dot-Com Boom and Surviving the Bust

The late 1990s and early 2000s were a wild ride for tech investors. The dot-com boom created enormous wealth, but the subsequent bust wiped out many companies. SoftBank, like everyone else, wasn't immune to the volatility. But Son's long-term vision and diversified portfolio helped the company weather the storm.

Learning from Mistakes: A Key to Long-Term Success

Son didn't always get it right. Some of his investments didn't pan out. But he learned from these mistakes, refining his investment strategy and becoming even more discerning in his choices. The key to success, as Son demonstrates, is not avoiding failure, but learning from it.

The Alibaba Bet: A Masterstroke of Investment Genius

Perhaps Son's most famous and arguably most successful investment was in Alibaba, the Chinese e-commerce giant. In 2000, he invested $20 million in the then-fledgling company. That investment is now worth billions. It's a testament to Son's ability to spot potential and his willingness to take risks on unconventional ideas.

Why Alibaba? Understanding the Rationale

What made Son so confident in Alibaba? He saw the potential of the Chinese market and recognized Jack Ma's vision. He understood that Alibaba could revolutionize e-commerce in China. It wasn't just about the numbers; it was about the people and the potential.

The Vision Fund: A $100 Billion Bet on the Future

In 2017, SoftBank launched the $100 billion Vision Fund, the largest technology-focused venture capital fund in history. This was a bold statement, signaling SoftBank's commitment to investing in disruptive technologies like artificial intelligence, robotics, and the Internet of Things. The Vision Fund aimed to fuel the growth of companies poised to reshape industries.

Investing in the Future: AI, Robotics, and Beyond

The Vision Fund has invested in a wide range of companies, including Uber, DoorDash, and Fanatics. These investments reflect Son's belief that technology will continue to transform our lives and that the companies leading this transformation will generate significant returns. He is not just investing in companies; he's investing in the future.

Controversies and Challenges: Navigating the Storm

Son's journey hasn't been without its challenges. The Vision Fund has faced criticism for its high-profile investments and its impact on the venture capital landscape. Some argue that the fund's massive size has distorted valuations and created unsustainable bubbles.

WeWork: A Cautionary Tale

The WeWork debacle serves as a cautionary tale. SoftBank invested heavily in the co-working company, but WeWork's IPO collapsed amid concerns about its business model and governance. This experience highlighted the risks associated with investing in high-growth, unproven companies. It also underscored the importance of due diligence and responsible investing.

Son's Leadership Style: Visionary and Bold

Masayoshi Son is known for his bold vision, his unwavering confidence, and his willingness to take risks. He's a charismatic leader who inspires his team and attracts top talent. He's not afraid to think big and challenge conventional wisdom.

The Importance of Gut Feeling: Trusting Intuition

While data and analysis are important, Son also relies on his intuition. He believes in trusting his gut feeling when making investment decisions. This might seem unconventional, but it has often served him well. He combines data-driven analysis with intuitive judgment to make informed decisions.

Philanthropy and Giving Back: A Commitment to Humanity

Beyond his business endeavors, Masayoshi Son is also a philanthropist. He has pledged significant sums to charitable causes, particularly those related to disaster relief and education. He believes in using his wealth to make a positive impact on the world.

The Great East Japan Earthquake: A Call to Action

The Great East Japan Earthquake in 2011 deeply affected Son. He donated generously to relief efforts and advocated for renewable energy. This event reinforced his commitment to using technology and innovation to address global challenges.

The Future of SoftBank: What's Next for the Tech Giant?

What's next for SoftBank under Son's leadership? The company is likely to continue investing in disruptive technologies and expanding its global reach. Son's long-term vision remains focused on artificial intelligence and its potential to transform industries. Expect SoftBank to be at the forefront of the next wave of technological innovation.

Conclusion: Lessons from a Tech Titan

Masayoshi Son's journey is a testament to the power of vision, perseverance, and calculated risk-taking. He transformed a small software distribution company into a global technology powerhouse. His success is not just about the money; it's about his ability to see the future and his unwavering commitment to innovation. His story offers valuable lessons for aspiring entrepreneurs and investors alike: Dare to dream big, be willing to take risks, learn from your mistakes, and always stay ahead of the curve. Most importantly, remember that technology has the power to change the world.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about Masayoshi Son and his career:

-

Q: How did Masayoshi Son make his first million?

A: While studying at UC Berkeley, he invented an electronic translator and sold the patent to Sharp for a million dollars.

-

Q: What is SoftBank's Vision Fund?

A: The Vision Fund is a $100 billion technology-focused venture capital fund established by SoftBank to invest in companies in fields like AI, robotics, and IoT.

-

Q: What was Masayoshi Son's most successful investment?

A: His investment in Alibaba, the Chinese e-commerce giant, is widely considered his most successful, generating billions of dollars in returns.

-

Q: What are some challenges SoftBank has faced?

A: SoftBank has faced criticism regarding the size and impact of its Vision Fund, as well as challenges with investments like WeWork.

-

Q: What is Masayoshi Son's leadership style?

A: Son is known for his visionary leadership, bold decision-making, and willingness to take risks. He often combines data analysis with his intuition when making investments.