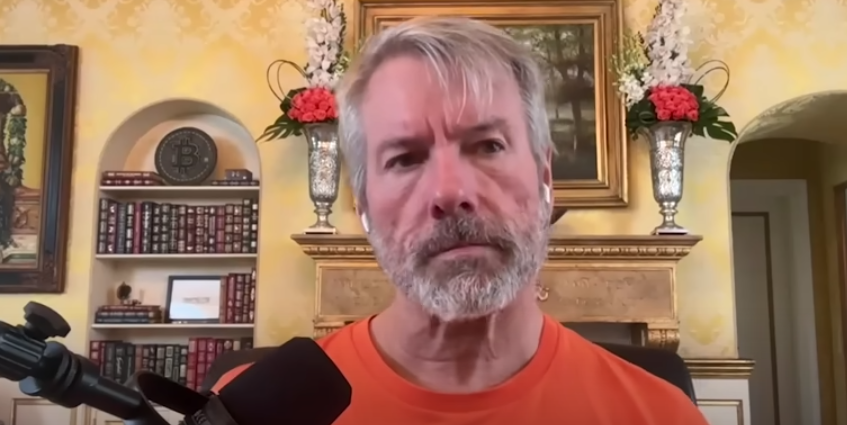

Michael Saylor's Bitcoin Bonanza: How He Built a $10.2 Billion Empire

Introduction: From Dot-Com Darling to Bitcoin Bull

The story of Michael Saylor is a wild ride through the peaks and valleys of modern finance. He's a tech visionary who witnessed the explosive growth of the internet, experienced the gut-wrenching crash of the dot-com bubble, and then, in a move that surprised many, doubled down on Bitcoin. Today, he commands a $10.2 billion fortune, a testament to his resilience and, let's face it, a healthy dose of audacious risk-taking. But how exactly did he build this massive wealth? It's a journey that blends technological innovation with a bold investment strategy, making him a fascinating figure in both the tech and crypto worlds.

Early Days: A Prodigy Takes Flight

The MIT Years: Laying the Foundation

Michael Saylor's journey began with a strong academic foundation. He graduated from MIT with degrees in aeronautics and astronautics and science, technology, and society. This diverse education equipped him with a unique perspective, blending technical prowess with an understanding of the societal impact of technology. This combination would prove crucial in his future endeavors.

Founding MicroStrategy: The Data Revolution

In 1989, Saylor co-founded MicroStrategy, a business intelligence software company, with Sanju Bansal. Their vision was to empower businesses with data-driven insights. Think of it like this: instead of relying on gut feelings, companies could use MicroStrategy's software to analyze vast amounts of data and make informed decisions. This was a groundbreaking concept in the early days of data analytics.

The Dot-Com Boom: Riding the Wave (Almost Too High)

IPO Glory: A Rocket Ship to Riches

MicroStrategy's initial public offering (IPO) in 1998 was a spectacular success. Shares of the company doubled on the first day of trading, a feat that was almost unheard of at the time. This catapulted Saylor into the billionaire stratosphere, with his net worth reaching a staggering $7 billion by 2000. He was the poster child for the dot-com boom, an entrepreneurial icon.

The Accounting Scandal: A Near-Death Experience

However, the fairytale didn't last. In 2000, the SEC launched an investigation into MicroStrategy's accounting practices, alleging that the company had overstated its revenues. The scandal sent MicroStrategy's stock plummeting, wiping out billions of dollars in market capitalization and significantly reducing Saylor's personal wealth. It was a harsh lesson in the fragility of success and the importance of ethical business practices.

Rebuilding and Reimagining: The Phoenix Rises

Weathering the Storm: A Test of Resilience

The accounting scandal was a major setback, but Saylor didn't give up. He worked to restore MicroStrategy's reputation and rebuild the company. This period showcased his resilience and determination to overcome adversity. He implemented stricter accounting practices and focused on delivering value to his customers.

The Pivot to Bitcoin: A Controversial Bet

In 2020, Saylor made a bold move that would redefine his legacy: he began investing MicroStrategy's cash reserves in Bitcoin. This was a controversial decision, as Bitcoin was still a relatively new and volatile asset. Many questioned his sanity, but Saylor was convinced that Bitcoin was the future of money.

The Bitcoin Strategy: All-In on the Digital Gold

A Visionary Approach: Seeing Beyond the Hype

Saylor's investment in Bitcoin wasn't just a gamble; it was a calculated bet based on his understanding of macroeconomic trends and the potential of digital assets. He argued that Bitcoin was a superior store of value compared to traditional assets like cash and gold. He saw it as a hedge against inflation and a way to preserve MicroStrategy's capital over the long term.

Dollar-Cost Averaging: Buying the Dips

MicroStrategy didn't just buy Bitcoin once; they adopted a dollar-cost averaging strategy, consistently purchasing Bitcoin over time, regardless of the price. This approach helped to mitigate the risk of buying at the top and allowed them to accumulate a significant amount of Bitcoin over time.

Leveraging Debt: Amplifying the Returns

To further increase its Bitcoin holdings, MicroStrategy issued debt, using the proceeds to purchase even more Bitcoin. This leveraged approach amplified both the potential gains and the potential losses. It was a high-risk, high-reward strategy that ultimately paid off handsomely.

The Bitcoin Evangelist: Spreading the Word

A Vocal Advocate: Leading the Charge

Saylor became a vocal advocate for Bitcoin, using his platform to educate the public about its benefits and potential. He often appeared on podcasts, in interviews, and on social media, sharing his insights and encouraging others to invest in Bitcoin. He became a leading figure in the Bitcoin community, attracting a large following of supporters.

Building a Community: Fostering Adoption

Saylor's evangelism helped to foster a sense of community around Bitcoin, encouraging wider adoption and legitimizing the asset class. He played a key role in shaping the narrative around Bitcoin, positioning it as a long-term store of value rather than just a speculative asset.

The $10.2 Billion Fortune: Riding the Bitcoin Wave

The Bitcoin Boom: A Rising Tide Lifts All Boats

As Bitcoin's price soared, so did Saylor's net worth. MicroStrategy's stock price became closely correlated with Bitcoin's price, reflecting the company's massive Bitcoin holdings. This resulted in a significant increase in Saylor's personal wealth, propelling him back into the ranks of the world's richest people.

A Rollercoaster Ride: Navigating Volatility

However, the ride hasn't been without its bumps. Bitcoin's price is notoriously volatile, and MicroStrategy's stock has experienced significant fluctuations as a result. Saylor has remained steadfast in his belief in Bitcoin's long-term potential, even during periods of market downturn.

The Future of Saylor and MicroStrategy: What's Next?

Doubling Down on Bitcoin: A Long-Term Commitment

Saylor remains committed to Bitcoin and plans to continue accumulating the asset over time. He believes that Bitcoin will eventually become the dominant form of money and that MicroStrategy is well-positioned to benefit from this trend. He's essentially betting the farm on Bitcoin, a bold move that could either solidify his legacy or lead to another significant setback.

Beyond Bitcoin: Expanding Horizons

While Bitcoin is currently MicroStrategy's primary focus, the company is also exploring other potential applications of blockchain technology. This suggests that Saylor is looking beyond Bitcoin and considering other ways to leverage the power of decentralized technologies. He's not just a Bitcoin bull; he's a believer in the transformative potential of blockchain.

Conclusion: Lessons from the Bitcoin Billionaire

Michael Saylor's journey is a compelling story of innovation, resilience, and bold risk-taking. He went from dot-com darling to near financial ruin and then reinvented himself as a Bitcoin evangelist, ultimately building a $10.2 billion fortune. His story teaches us the importance of adaptability, the power of conviction, and the potential rewards of taking calculated risks. Whether you agree with his investment strategy or not, there's no denying that Michael Saylor is a force to be reckoned with in the world of technology and finance. He demonstrated that failures do not have to be the end of the road. The man reinvented himself in the world of digital assets and made a massive fortune. His success is a demonstration of what can happen if a person combines ingenuity and perseverance.

Frequently Asked Questions

Q1: What is MicroStrategy's primary business?

MicroStrategy is a business intelligence software company that provides analytics and reporting tools to businesses.

Q2: Why did Michael Saylor invest MicroStrategy's cash reserves in Bitcoin?

Saylor believes that Bitcoin is a superior store of value compared to traditional assets and a hedge against inflation.

Q3: What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money in an asset at regular intervals, regardless of the price.

Q4: How much Bitcoin does MicroStrategy currently hold?

MicroStrategy holds a substantial amount of Bitcoin. The exact number varies because they are still actively purchasing Bitcoin, so check the official resources.

Q5: What are the risks associated with MicroStrategy's Bitcoin strategy?

The main risks are Bitcoin's price volatility and the potential for losses if the price of Bitcoin declines significantly.