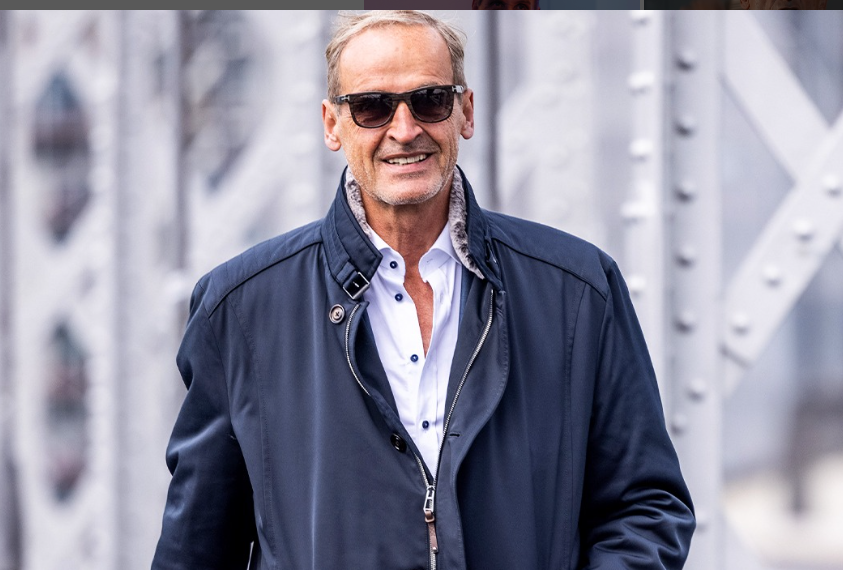

Florian Homm: Unmasking a Hedge Fund Maverick's Fortune and Controversies

Introduction: The Enigmatic Life of Florian Homm

Florian Homm. The name alone evokes a mix of awe, intrigue, and perhaps a healthy dose of skepticism. A hedge fund manager who reportedly amassed a fortune nearing €400 million, only to become embroiled in accusations of fraud and legal battles. How did he achieve such dizzying heights, and what secrets lie behind his dramatic rise and fall? That’s exactly what we're diving into.

The Rise of a Hedge Fund Titan

Homm's success story is rooted in the world of high finance. He carved out a name for himself as a shrewd and aggressive hedge fund manager, known for his bold investment strategies. But what exactly did he do to garner such success?

Early Career and Strategic Acumen

Like many successful figures in finance, Homm’s journey started with a strong educational foundation. He honed his understanding of markets and investment strategies, which laid the groundwork for his later ventures. Was it just education or was there something more?

Building a Hedge Fund Empire

Homm’s hedge fund quickly became a force to be reckoned with, managing up to $3 billion in assets for its clients. That's a lot of trust (and money!). But what strategies did he employ to attract such a massive inflow of capital?

The Allure of High-Risk Investments

Hedge funds are known for their willingness to take calculated risks, and Homm's organization was no exception. But what separated him from the pack?

Identifying Untapped Opportunities

Homm had a knack for identifying undervalued assets and emerging markets. It was this sharp eye that allowed him to deliver impressive returns for his investors. He was like a financial bloodhound sniffing out profit wherever it lay.

Aggressive Trading Strategies

Homm's firm was known for its aggressive trading strategies, which often involved short selling and leveraged investments. These tactics can amplify gains, but also significantly increase the risk of losses. High risk, high reward, right?

The Dark Side of Success: Controversy and Allegations

Unfortunately, Homm's success was not without its shadows. Accusations of questionable business practices began to surface, casting a dark cloud over his achievements.

Allegations of Securities Fraud

In the United States, Homm faced serious allegations of securities fraud. The charges painted a picture of a manager who manipulated markets for personal gain. These are serious accusations, so what were the specifics?

The Flight and Arrest

Facing mounting legal pressure, Homm fled the country, becoming a fugitive from justice. His dramatic escape and subsequent arrest in Italy added another layer of intrigue to his already controversial story. It was like a scene straight out of a financial thriller.

Unraveling the Legal Battles

The legal battles that followed Homm's arrest were complex and protracted. The allegations against him were serious, and the stakes were incredibly high.

Extradition Attempts and Court Proceedings

The US government sought Homm's extradition to face charges, but he fought against it. The court proceedings were closely watched by the financial world. What arguments did his lawyers put forward?

The Outcome of the Legal Battles

The outcome of the legal proceedings was a key determinant of Homm's fate, influencing not only his personal freedom but also the future of his assets. The world waited with bated breath.

The Question of Wealth: How Much is Homm Still Worth?

Despite the controversies and legal battles, a persistent question remains: how much wealth does Florian Homm still possess?

Assets and Investments

It's speculated that Homm amassed a significant personal fortune through his hedge fund activities. Tracking these assets is no simple task. Is it possible some of the assets are hidden offshore?

The Impact of Legal Settlements

Legal settlements and fines likely took a toll on Homm's net worth. But to what extent remains uncertain. How much was he ordered to pay?

Speculation and Estimates

Estimating Homm's current net worth is difficult given the complexity of his financial affairs and the confidential nature of his assets. Most figures are estimates based on available information and deductions made by researchers. It’s a financial detective's puzzle.

Lessons Learned: What Can We Learn from Homm's Story?

The story of Florian Homm offers valuable lessons about the world of finance, the allure of wealth, and the consequences of unethical behavior.

The Importance of Ethical Conduct

Homm's case highlights the importance of ethical conduct in the financial industry. Short-term gains should never come at the expense of integrity and responsible practices. Ethical behavior is not just good; it's good for business in the long run.

The Risks of Unregulated Markets

The complexities of hedge fund operations and the potential for abuse underscore the need for robust regulation and oversight. Unchecked greed can have devastating consequences. A balance between innovation and regulation is crucial.

Due Diligence and Investor Awareness

Investors should exercise caution and conduct thorough due diligence before entrusting their money to any fund manager. A flashy resume is not enough. Ask the tough questions and demand transparency.

The Legacy of Florian Homm

Whether viewed as a brilliant financial strategist or a rogue operator, Florian Homm's story will continue to fascinate and provoke debate. He serves as a stark reminder of the seductive power of wealth and the importance of ethical boundaries in the world of finance.

Conclusion: A Cautionary Tale of Ambition and Excess

The story of Florian Homm is a complex tapestry woven with threads of financial genius, ambition, and alleged misconduct. His dramatic rise and fall serve as a cautionary tale for anyone seeking wealth and power in the high-stakes world of finance. While his fortune may be debated, one thing is certain: his legacy will be etched in the annals of financial history.

Frequently Asked Questions

Q1: What were the main allegations against Florian Homm?

The main allegations against Florian Homm included securities fraud and market manipulation, primarily related to his activities as a hedge fund manager in the United States.

Q2: Where was Florian Homm arrested after fleeing the US?

Florian Homm was arrested in Italy after fleeing the United States to avoid facing the fraud charges.

Q3: How much money did Florian Homm reportedly manage at his peak?

At the peak of his career, Florian Homm's organization managed approximately $3 billion in assets for its clients.

Q4: Is Florian Homm still considered a fugitive?

While specific details of any current legal status might have shifted, at the time of the major legal actions against him, Florian Homm was considered a fugitive when he initially fled the United States.

Q5: What is the main lesson to be learned from the Florian Homm story?

The main lesson from the Florian Homm story is the importance of ethical conduct and transparency in the financial industry. It highlights the potential dangers of unchecked ambition and the need for robust regulation and due diligence.